Table of Contents

The Apple Credit Card is a popular choice for many Apple users who are looking for a simple and convenient way to manage their finances. This article will guide you through the process of applying for the Apple credit card and provide you with all the information you need to make an informed decision.

What is the Apple Credit Card?

The Apple Credit Card, also known as the Apple Card, is a credit card offered by Apple in partnership with Goldman Sachs. It is designed to seamlessly integrate with your iPhone and other Apple devices, making it easy to manage your finances on the go.

Features of the Apple Credit Card

The Apple credit card apply comes with a range of features that set it apart from traditional credit cards. One of the key features is the absence of any fees, including annual fees, foreign transaction fees, and late payment fees. The card also offers daily cash back rewards and a high-yield savings account for Apple Card users.

Benefits of using the Apple Credit Card

There are several benefits to using the Apple Credit Card. Firstly, you can earn cash back for every purchase you make with the card. The cash back is deposited into your Apple Cash card, which can be used for purchases or transferred to your bank account. Additionally, the Apple Credit Card offers a range of security features to protect your financial information.

How to apply for the Apple Credit Card?

To apply for the Apple Credit Card, you need to have an iPhone or iPad with the latest iOS version installed. Open the Wallet app on your device and follow the on-screen prompts to apply for the card. You will need to provide your personal information, including your Apple ID, as well as consent to a credit check.

For the purpose of applying for the Apple Credit Card, what credit score is required?

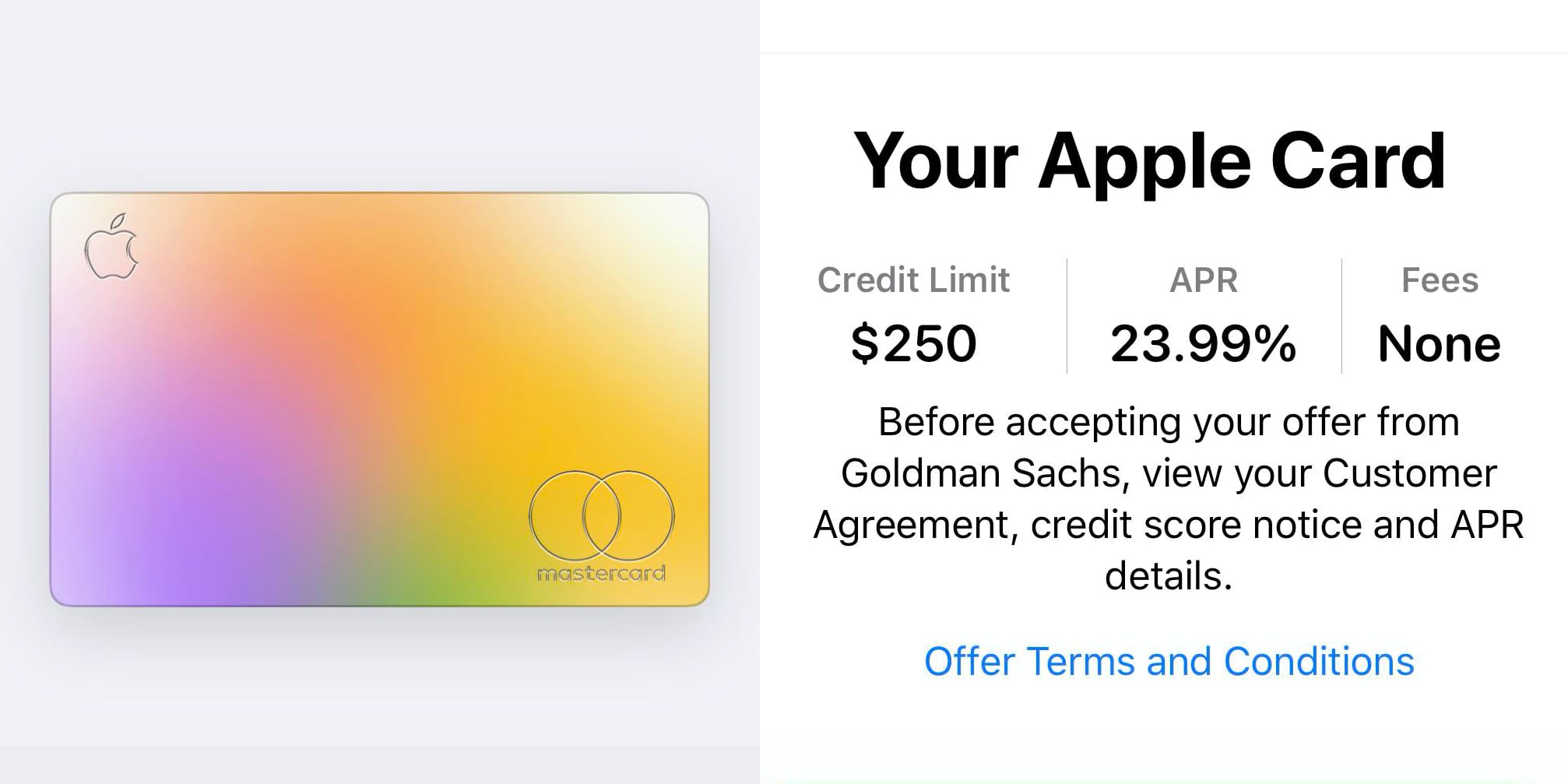

Understanding credit scores is essential when applying for any credit card. The minimum credit score requirements for the Apple credit card apply vary, but it is generally recommended to have a good or excellent credit score to increase your chances of approval.

How to improve your credit score?

Start by reviewing your credit report for any errors or inaccuracies and dispute them with the credit bureaus if necessary. Pay your bills on time and in full, reduce your credit card balances, and avoid opening new credit accounts unless necessary. Consistently practicing good financial habits will gradually improve your credit score over time.

How does the Apple Credit Card work with an iPhone?

The Apple credit card apply is seamlessly integrated with the Wallet app on your iPhone, making it easy to manage your card and make payments. Once your application is approved, you will receive a virtual card that can be used for online purchases and Apple Pay transactions. If you prefer a physical card, you can request a titanium Apple Card, which can be used wherever Mastercard is accepted.

Using the Apple Wallet app

The Apple Wallet app is your central hub for managing your Apple Credit Card. From the app, you can view your transaction history, make payments, and track your cash back rewards. You can also set up notifications to keep you informed about your spending and payment due dates.

Apple Pay integration

Apple Pay is a convenient and secure way to make contactless payments using your iPhone or Apple Watch. With the Apple Credit Card, you can use Apple Pay for in-store and online purchases. Simply add your Apple credit card apply to the Wallet app and follow the prompts to set up Apple Pay.

Managing your Apple Credit Card on your iPhone

The Apple Credit Card makes it easy to manage your card from your iPhone. You can view your current balance, available credit, and recent transactions right from the Wallet app. You can also schedule payments, set up automatic payments, and track your spending habits to stay on top of your finances.

What are the benefits of using the Apple Credit Card?

Using the Apple credit card comes with a range of benefits. One of the key benefits is the ability to earn cash back on every purchase. The cash back rewards are deposited into your Apple Cash card, which can be used for future purchases or transferred to your bank account. Additionally, the Apple Credit Card offers a high-yield savings account for Apple Card users.

Earning cash back

With the Apple Credit Card, you can earn cash back on every purchase. You earn 2% cash back when you use Apple Pay for transactions, 3% cash back on purchases from Apple, and 1% cash back on all other purchases made with your physical Apple Credit Card.

Apple Card family sharing

The Apple Credit Card offers a feature called Apple Card Family, which allows you to share your card with family members. This feature enables you to track spending, set spending limits, and manage the finances of your entire family from a single account.

High-yield savings account

The Apple Credit Card includes a high-yield savings account called Apple Card Monthly Installments. This feature allows you to finance certain Apple products and pay for them in monthly installments without any interest.

How can I use Apple Pay with my Apple Credit Card?

Apple Pay is a convenient and secure way to make payments with your Apple Credit Card. Setting up Apple Pay is easy. Open the Wallet app, tap on the “+” button to add a card, and follow the prompts to add your Apple Credit Card to Apple Pay.

Conclusion:

Apple credit card apply, a partnership with Goldman Sachs, integrates with iPhones and other Apple devices for easy financial management. It offers features like no fees, daily cash back rewards, and a high-yield savings account. To apply, users need an iPhone or iPad with the latest iOS version, making it easy to manage your finances on the go. personal information, and consent to a credit check.

For More Information Please Visit These Websites Craiyon And arturia