Table of Contents

Understand student loan forgiveness options in 2024, including recent updates, available programs, and helpful resources. Get informed and explore potential benefits and opposing viewpoints.

Student Loan Forgiveness Explained

Student loan forgiveness refers to programs that discharge all or part of a borrower’s federal student loan debt when they meet certain requirements. These programs aim to help borrowers who face challenges repaying their loans, such as those working in public service or struggling financially.

It’s important to remember that forgiveness is not automatic and eligibility requirements vary depending on the specific program.

Updates of Student Loan Forgiveness 2024

February 2024

Borrowers enrolled in the Income-Driven Repayment (IDR) plan may begin seeing automatic forgiveness as early as this month. The Department of Education (DOE) announced they are addressing past issues that led to inaccurate payment counts, ensuring qualifying borrowers receive credit towards forgiveness.

January 2024

The Biden-Harris administration approved an additional $4.9 billion in student loan forgiveness, bringing the total to $136.6 billion for over 3.7 million borrowers. This forgiveness primarily benefits public service workers and those enrolled in income-driven repayment plans.

July 2024

The Saving AmeNica’s Value Education (SAVE) plan takes full effect. This plan offers forgiveness after 10 years of payments for borrowers who originally took out $12,000 or less in federal student loans. Additionally, the plan implements maximum repayment terms based on the loan amount, offering some borrowers shorter repayment periods.

Understanding Forgiveness Programs

Several existing federal student loan forgiveness programs are available, each with specific eligibility criteria. Here’s a brief overview of some key programs:

Public Service Loan Forgiveness (PSLF)

This program forgives the remaining balance of federal student loans for public service workers after 10 years of qualifying payments and employment.

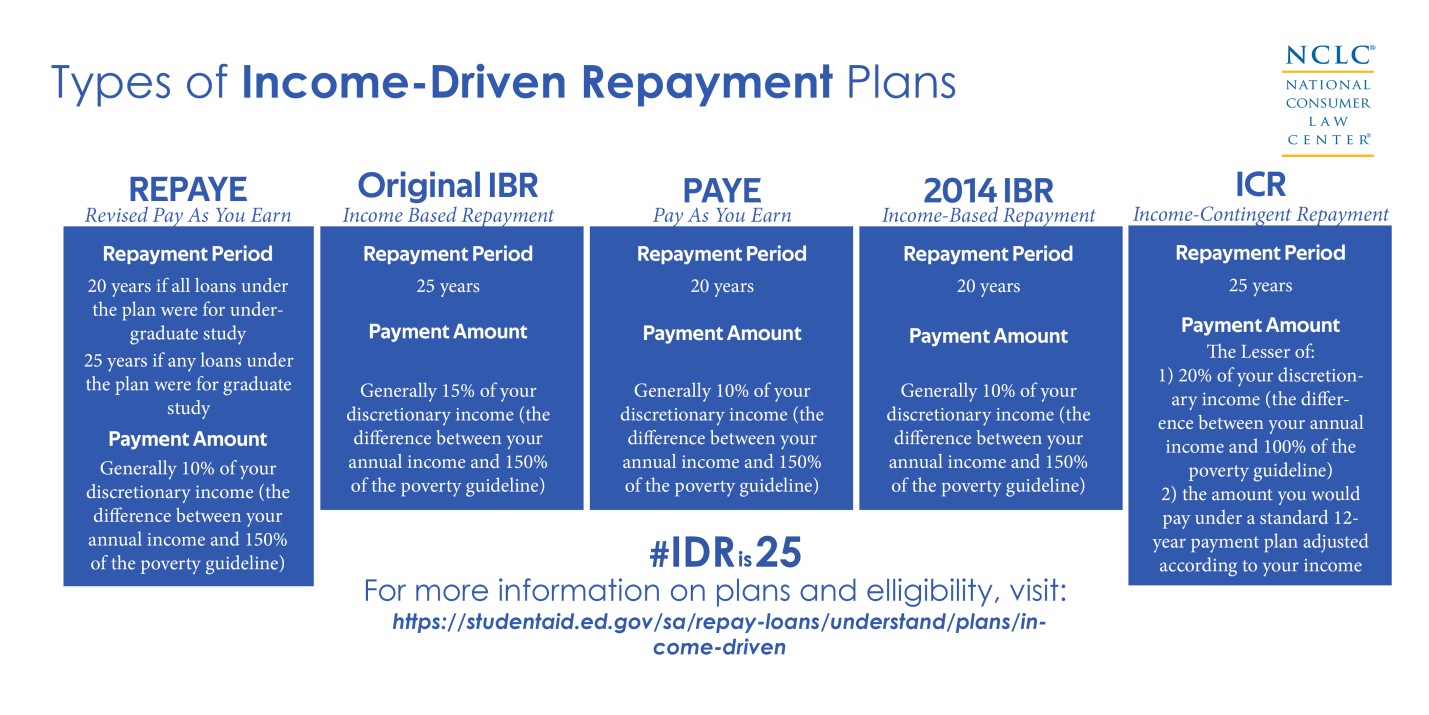

Income-Driven Repayment (IDR) forgiveness

Borrowers enrolled in IDR plans can have their remaining balance forgiven after 20 or 25 years of qualifying payments, depending on the specific plan.

Teacher Education Assistance for College and Higher Education (TEACH Grant)

This program provides grants of up to $4,000 per year to students who agree to teach in high-need fields for at least four years. If the service commitment is not fulfilled, the grant converts to a loan, but it can be forgiven through teaching service.

Arguments in Favor of Student Loan Forgiveness

There are several arguments in favour of student loan forgiveness, often cited by proponents of the policy. Here are some of the most common reasons:

Reduce the financial burden on borrowers

Student loan debt can be a significant financial burden for graduates, impacting their ability to afford housing, start families, and save for retirement. Forgiveness can alleviate this burden and improve borrowers’ overall financial well-being.

Promote economic growth

Some argue that forgiving student debt would free up money that borrowers could spend on other goods and services, stimulating the economy. Additionally, increased disposable income could allow borrowers to pursue further education or start businesses, potentially leading to long-term economic benefits.

Address racial and economic disparities

Studies show that student loan debt disproportionately impacts Black and Hispanic borrowers compared to white borrowers. Forgiveness could help close the racial wealth gap and promote economic equity.

Make higher education more accessible

By reducing the financial barrier of student loans, forgiveness could make higher education more accessible to individuals from low-income backgrounds, potentially leading to a more educated workforce and increased social mobility.

It’s important to note that this is a complex issue with opposing viewpoints and ongoing debate. Critics of student loan forgiveness raise concerns about the potential costs to taxpayers, the fairness of the policy to those who have already repaid their loans, and potential inflationary effects.

It’s crucial to consider all perspectives and research the topic thoroughly before forming an opinion.

For More Information Please Visit These Websites Craiyon And Arturia

1 Comment

zpvx1b